One of the most difficult tasks with a General Ledger is keeping it in balance. No matter how many 'traps' are entered into the system, somehow errors can occur. The Accountant has a routine to evaluate the ledger balance status, and isolate where problems occur.

Beginning / Ending Balances error

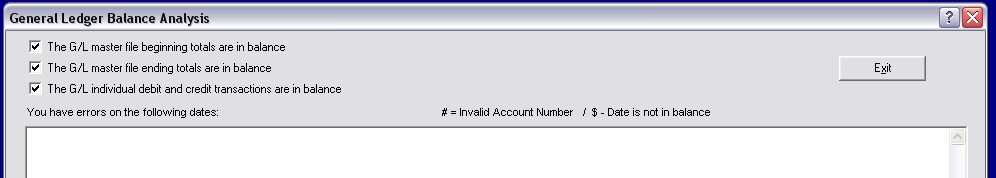

By selecting the Analysis option, the system will automatically test the total General Ledger, and report the findings. First, the system looks at the ending balance of all accounts on the General Ledger master file, and sees if the total for debit accounts equals that of the credit accounts. If so, it indicates the file is in balance.

If it is out of balance, you should print a Trial Balance, and compare the Beginning Balance amounts to the ending balance at the last closing (from your P/L or Balance Sheet).

The most likely cause of this type of error is that someone has changed the Beginning Balance field on a G/L account. The Beginning Balance shown on the Trial Balance is the same as the Ending Balance displayed when the G/L Account Editor is used. That amount is the sum of the months, plus the Beginning Balance on the Editor screen. Errors mostly occur when the Beginning Balances are adjusted between two accounts, and a closing has not yet been performed.

Transaction out of balance

Next, the system will evaluate all transactions in the current file. If the Debit and Credit Totals do not match, the system will report "Your Transactions are not in balance". It will then proceed to evaluate the transactions for each month. If an imbalance is shown, the system will list the month. Then it will perform a day by day analysis for that month, and list the dates of all days that are not balanced. The date displayed can then be entered into the Ledger Posting option for correction.

The most common cause of errors is one sided posting. For example, if a payment is received on an Accounts Receivable due amount, but only the Debit side is posted, the Credit side will have a deficit.

Account number error

Sometimes account numbers are omitted or in error. The final step is to analyze the quality of the account numbers, and dates where errors have occured will be posted for correction. Using Transaction Posting, these corrections can be made easily.